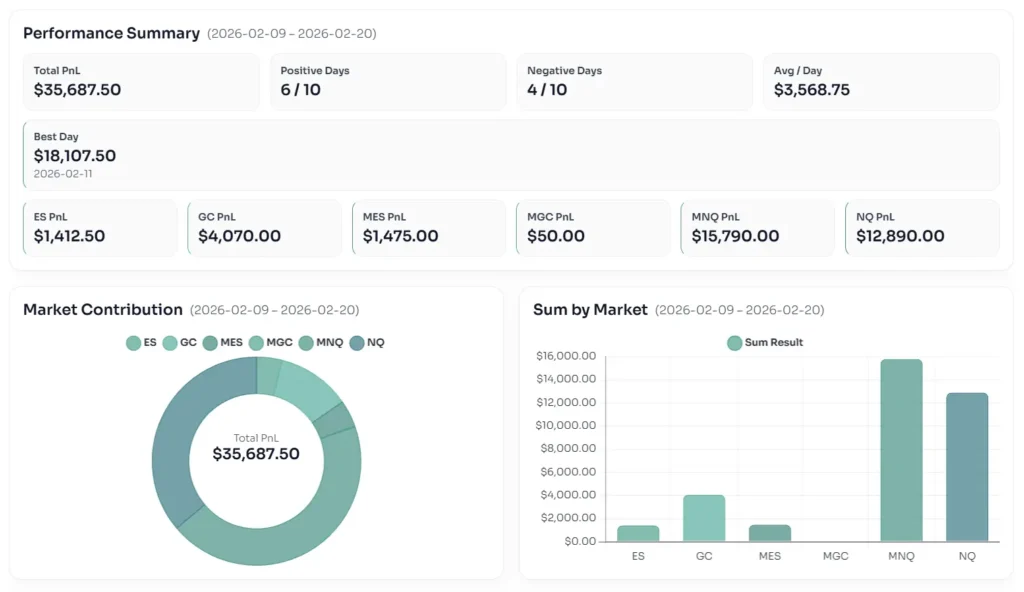

J Strategy NinjaTrader 8 performance report covering February 9–20, 2026. Automated multi-market futures trading across NQ, MNQ, ES and GC with full performance charts and breakdown.

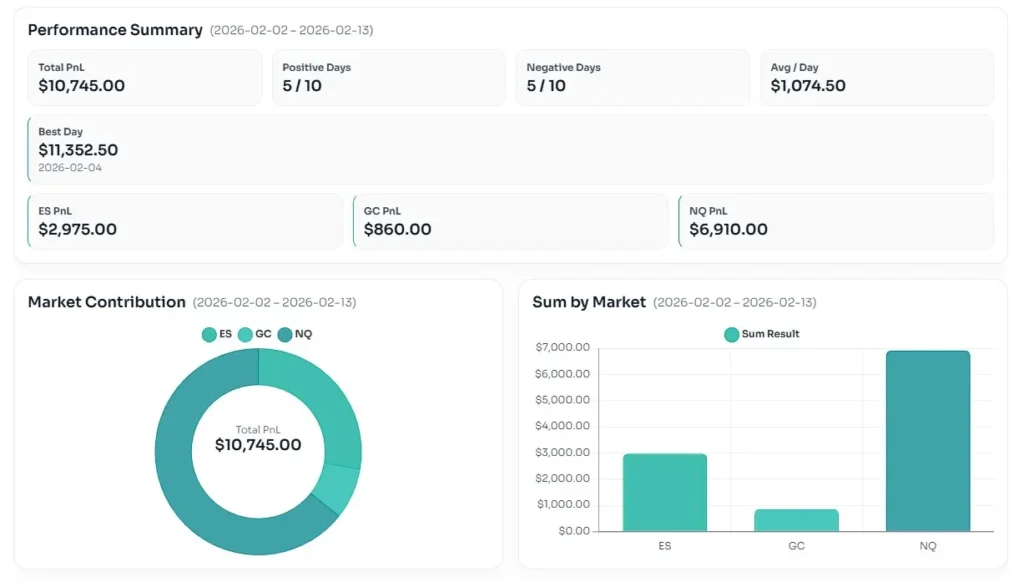

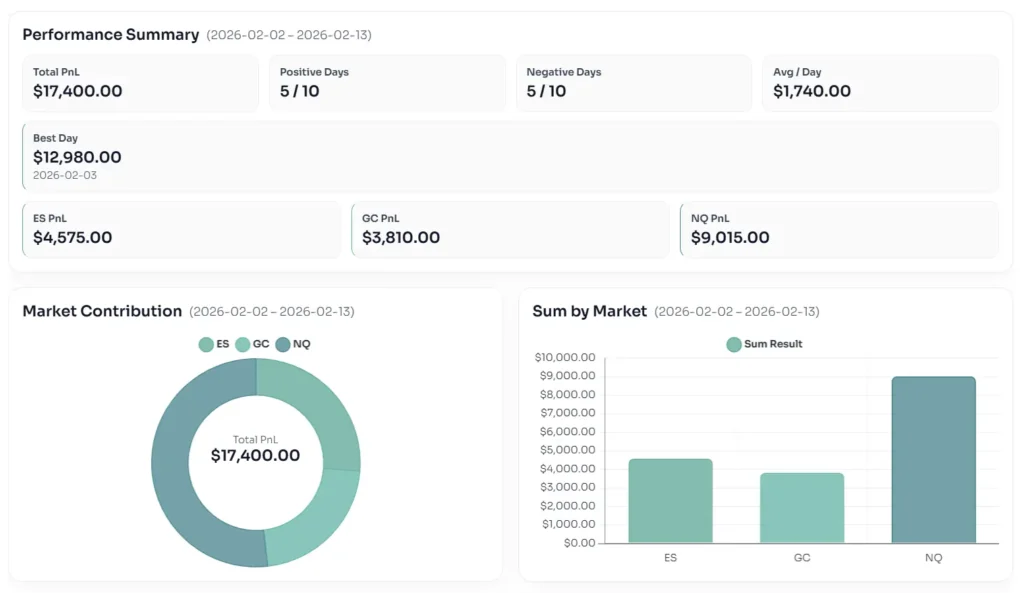

This Reversal Strategy NinjaTrader 8 report covers February 2–13, 2026, highlighting automated pullback trading across NQ, ES and GC. See full performance breakdown, daily results and market contribution charts.

M Trader NinjaTrader 8 strategy report covering August 4 – September 4, 2025. Multi-market automated trading across ES, NQ, GC and CL with centralized account execution.

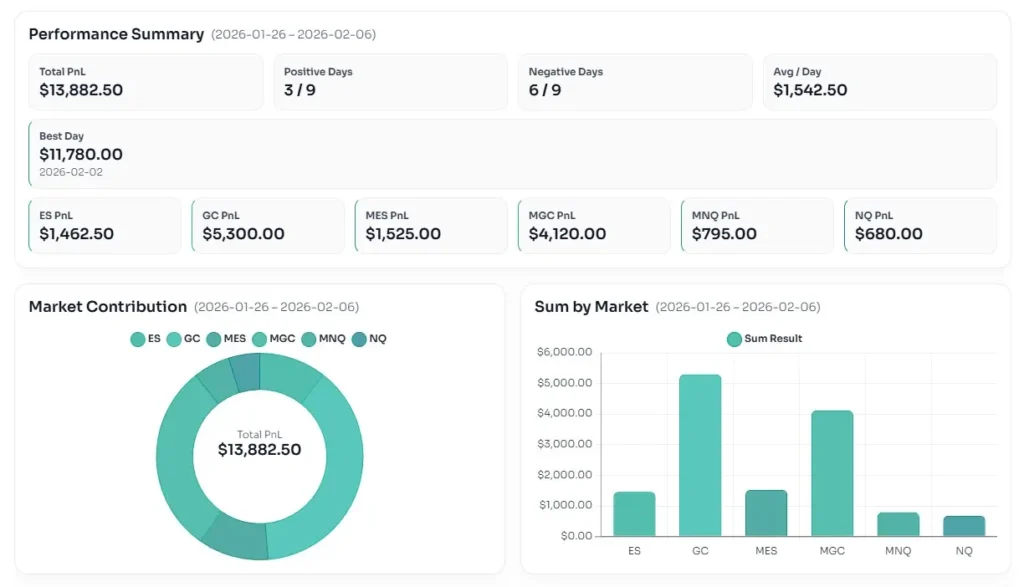

J Strategy delivered $13,882.50 between Jan 26 and Feb 6, 2026, highlighted by an $11,780.00 best day and strong GC performance.

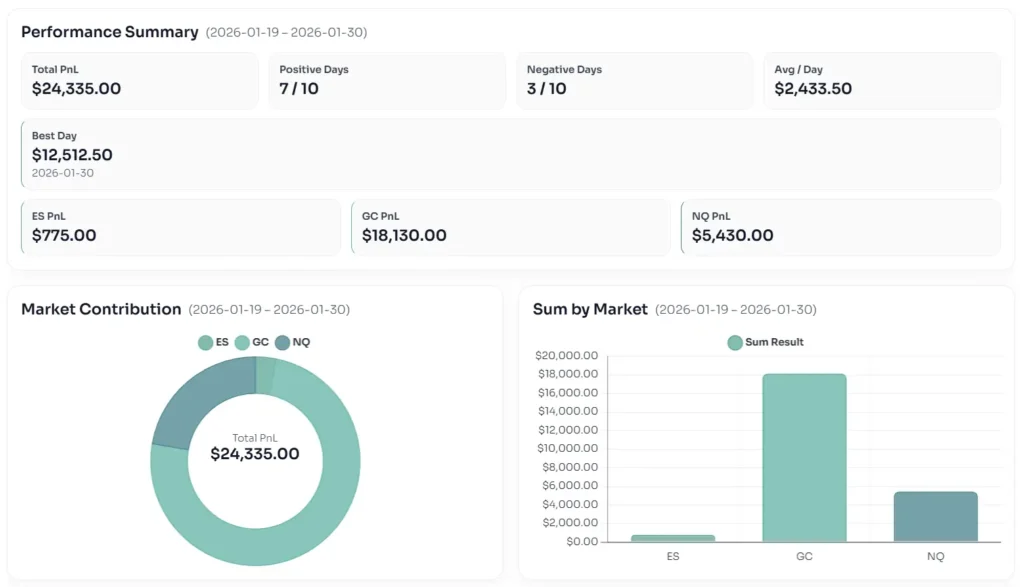

Reversal closed Jan 19–30, 2026 with a total profit of $24,335.00, highlighted by a $12,512.50 best day and strong GC-led performance.

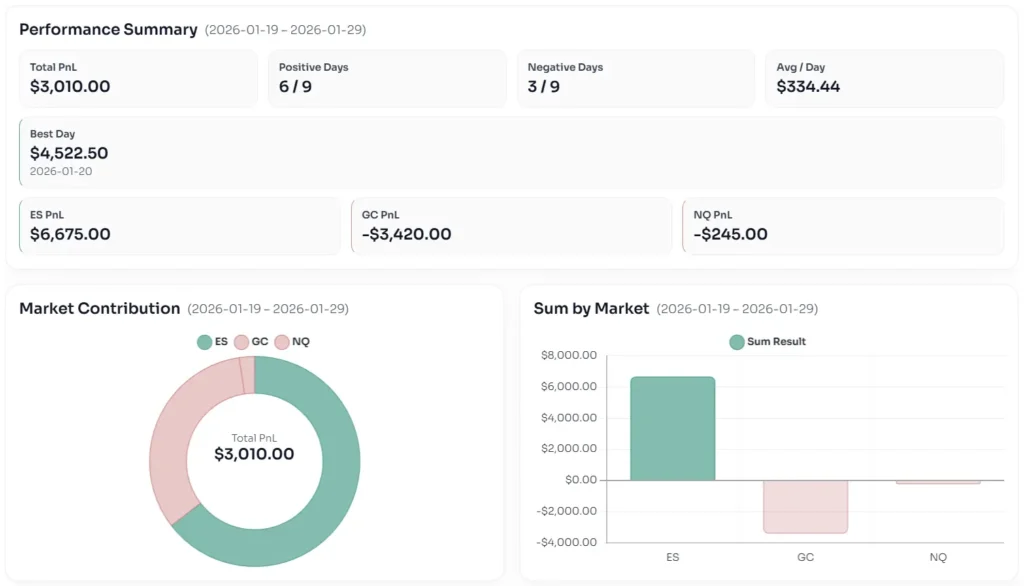

M Trader (20-minute) closed Jan 19–29, 2026 with a total profit of $3,010.00, highlighted by a $4,522.50 best day and strong ES performance.

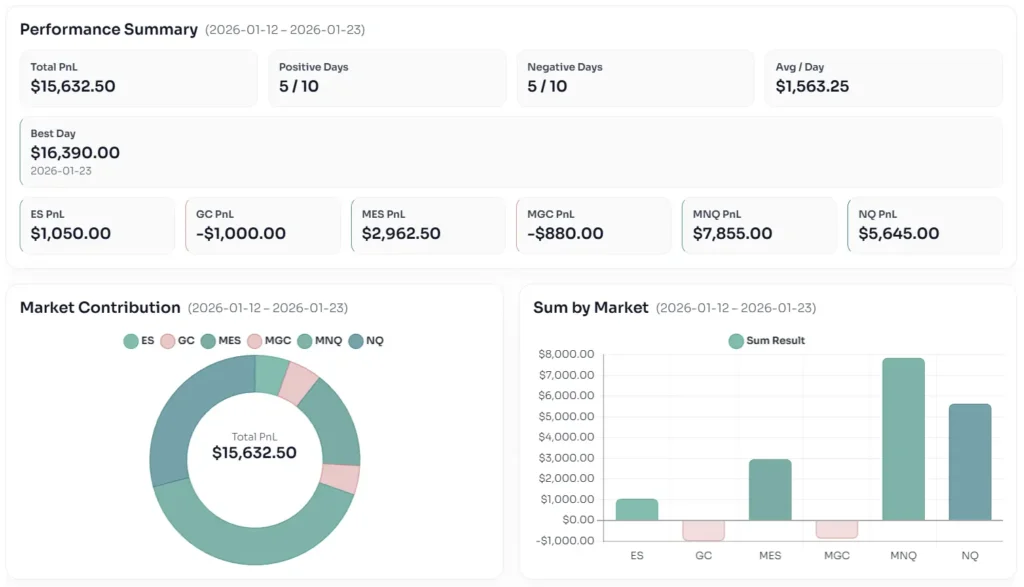

J Strategy returned after the New Year pause and posted $15,632.50 from Jan 12–23, 2026, led by a $16,390.00 best day and strong MNQ/NQ contribution.

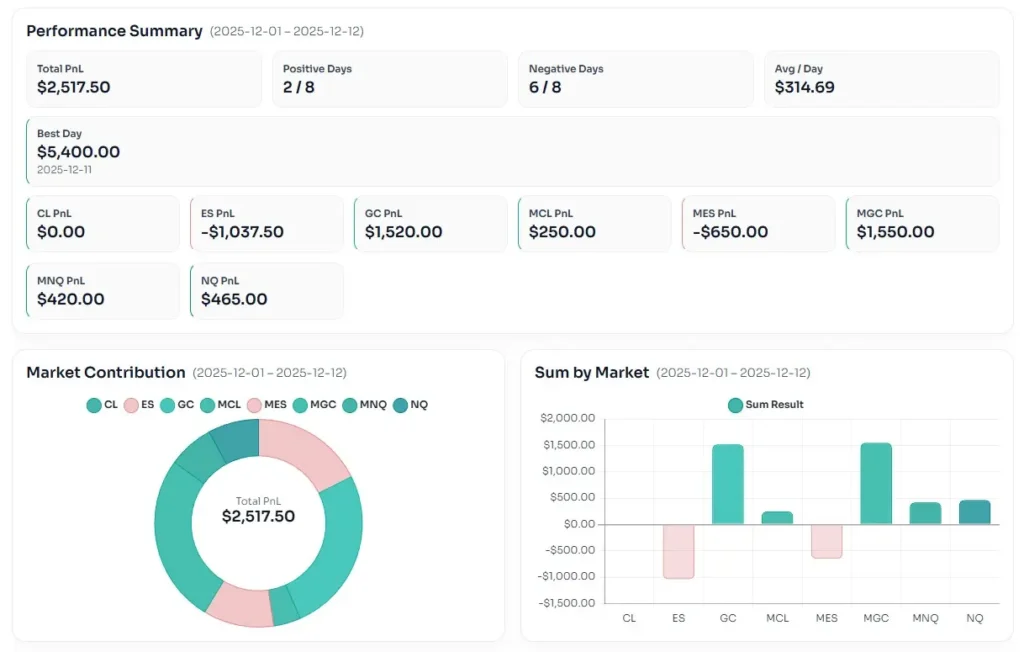

J Strategy closed the period from Dec 1 to Dec 12, 2025 with a total profit of $2,517.50, highlighted by a strong $5,400.00 best day. The report details daily results and multi-market performance across mixed conditions.

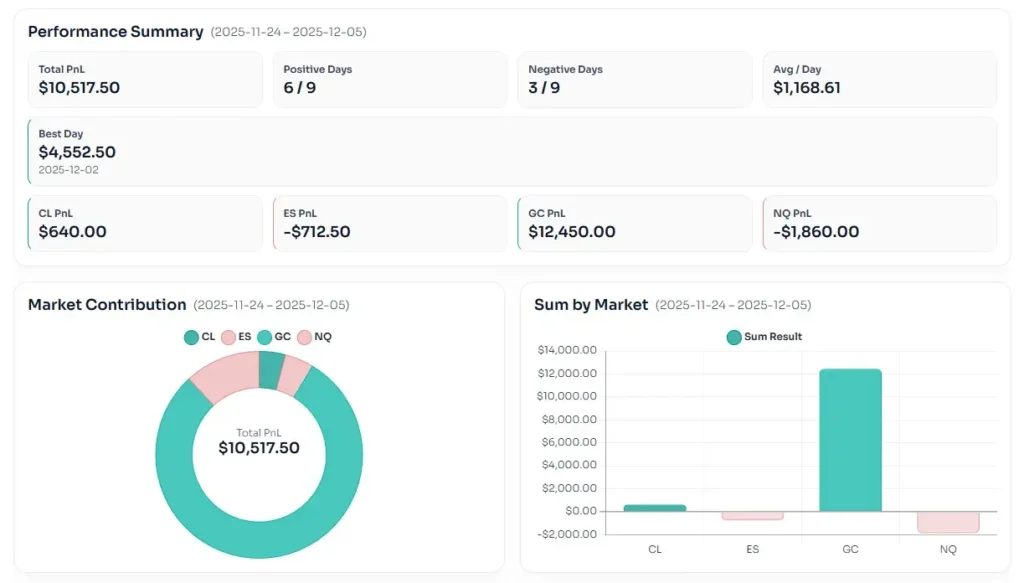

M Trader closed the period from Nov 24 to Dec 5, 2025 with a total profit of $10,517.50, driven by strong GC performance and several high-momentum trading days. The best session reached $4,552.50, showing consistent adaptability across multiple markets.

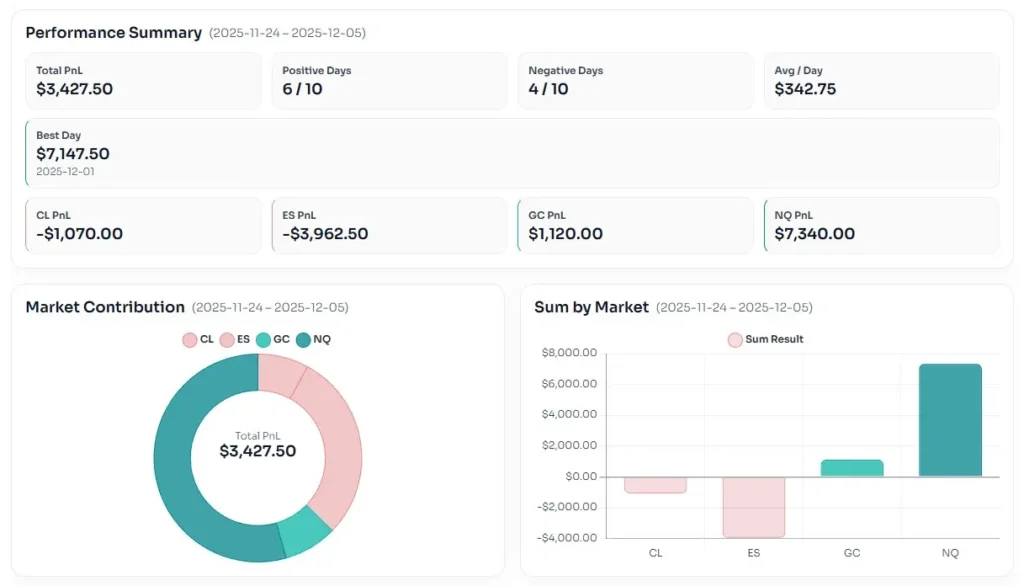

Total PnL $3,427.50, strongest results from NQ and GC, and a standout $7,147.50 day. Full market and daily performance summary.