How to Test and Use Templates for Automated Trading (NinjaTrader 8)

If you’re looking to streamline your trading and optimize your profits, automated trading using NinjaTrader 8 can be a game changer. With the right templates and strategies, you can leverage automation to execute trades consistently while you focus on risk and market context.

This guide walks you through a field-tested workflow to import, test, evaluate, and use templates. From setting up simulation accounts to rotating top performers, everything you need to get started is here.

Table of Contents 🔗

- Step 1: Import Trading Templates into NinjaTrader 8

- Step 2: Add Accounts for Testing

- Step 3: Test All Templates Simultaneously

- Step 4: Evaluate Template Performance

- Step 5: Use Templates Wisely

- Pro Tips & Setup Checklist

- Common Mistakes to Avoid

- FAQ

- Conclusion

Step 1: Import Trading Templates into NinjaTrader 8 🔗

Before testing, import your strategy templates so they’re available under Strategies. Use the original .zip files—don’t unzip them.

- Open NinjaTrader 8.

- Control Center → Tools → Import → NinjaScript Add-On.

- Select the strategy/template

.zipfiles and click Open. - Follow the prompts. On success, the strategies appear in the platform.

.zips so you can roll back if needed (e.g., Reversal_5m_v3.zip).Step 2: Add Accounts for Testing 🔗

Create simulation accounts that mirror your live conditions (balance, commissions, slippage). Group them by idea/timeframe so you can compare apples-to-apples.

- Control Center → Accounts tab.

- Right-click → Add Simulation Account.

- Name them by use (e.g.,

SimReversal5min,SimTrend15min). - Configure starting balance and Commission template to reflect reality.

- Click OK.

Step 3: Test All Templates Simultaneously 🔗

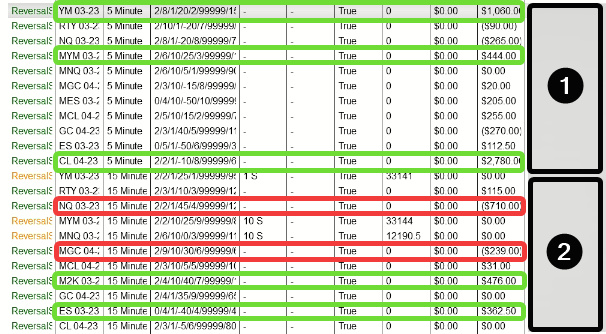

Attach all candidate templates to their designated sim account and run them at the same time. Leave the test uninterrupted for at least 3 trading days to capture a fair sample under the same market regime.

- Open the Strategies tab and enable the templates you want to test.

- Assign each template to the correct sim account (e.g., all 5-minute templates →

SimReversal5min). - Group by timeframe to compare cleanly: account #1 = 5m, account #2 = 15m, etc.

Step 4: Evaluate Template Performance 🔗

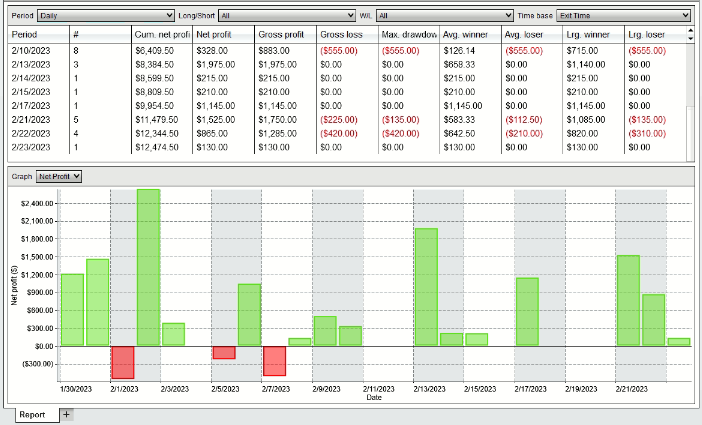

After 2–3 full trading days, review results. Promote only the templates that combine profitability with controlled drawdown.

- Open Trading Performance and review by strategy/template.

- Focus on net PnL (after commissions), average trade, win rate, and max drawdown.

- Shortlist templates with 2–3 green days and acceptable risk, then move them to your Main (live/eval) account.

Step 5: Use Templates Wisely 🔗

Deploy your winners, but be ready to rotate. No template is set-and-forget—markets change.

- Rotate regularly: weekly checks; deeper monthly review. Bench underperformers; promote fresh sim winners.

- Size by volatility: use ATR-based position sizing so each template risks a similar fraction of equity.

- Optimize sparingly: test ranges in Strategy Analyzer → Optimization, then validate out-of-sample or with walk-forward.

- News-aware: consider pausing or sizing down on high-impact releases if the template isn’t designed for that volatility.

Pro Tips & Setup Checklist 🔗

- Commission & slippage: set realistic values so Sim mirrors live.

- Trading hours: align strategy session templates (RTH vs ETH) with your method.

- Correlations: diversify across symbols/timeframes to avoid concentrated risk.

- ATMs / risk controls: ensure stops/targets are attached; cap per-template daily loss.

- Notes: log why you promoted a template—helps you know when to rotate out.

Common Mistakes to Avoid 🔗

- Judging on one day—insufficient sample size.

- Over-optimizing in-sample without out-of-sample validation.

- Ignoring commissions/slippage—gross PnL can be misleading.

- Mismatched sessions or data—results won’t match Analyzer/live.

- Relying on a single template for too long—don’t anchor; rotate.

FAQ 🔗

How long should I run template tests?

Run at least 2–3 full trading days for the first filter, then continue monitoring in Sim while promoting only clear winners.

Should I optimize parameters before going live?

Yes, but lightly—and always validate with out-of-sample data or walk-forward to avoid curve fitting.

Can I run multiple templates on the same account?

You can, but during testing keep them grouped by timeframe/idea on dedicated sim accounts. In production, ensure combined risk is within limits.

What commission/slippage settings should I use?

Use your broker’s schedule and typical slippage for your instrument/liquidity. Test a range to see sensitivity.

What if market regime changes quickly?

Bench laggards and promote fresh sim winners. That rotation keeps your basket aligned with current conditions.

Conclusion 🔗

Using templates for automated trading with NinjaTrader 8 is a practical way to systematize execution and compound small edges. Import your templates, run simultaneous tests for a few days, promote the consistent gainers, and rotate as conditions change. Keep risk controls tight and assumptions realistic (commissions, slippage, sessions) to ensure Sim-to-live continuity.

Explore Our Add-Ons & Tools

Enhance your NinjaTrader® 8 workflow with MASCapital’s collection of powerful add-ons and free tools. From performance utilities to precision indicators, every tool is built to simplify your trading experience and improve execution speed.

Lifetime Free

Free Indicators Pack

Download a complete starter set of NinjaTrader indicators to boost your technical edge with structure, momentum, and trend clarity — free forever.

Lifetime Free

Auto-Login & Cleaner

Save time and boost stability by automatically logging into NinjaTrader and clearing old files, logs, and cache with a single click.

14-Day Free Trial

Advanced Trader

Visualize active positions, stops, and targets directly on your chart while managing orders. Control every aspect of your trade!

7-Day Free Trial

Trade Analyzer + Web Report

Instantly analyze and visualize your NinjaTrader performance with detailed stats, charts, and reports that reveal your real trading edge.

14-Day Free Trial

Reversal Signal Indicator

Identify major turning points early using precision reversal logic that filters noise and highlights high-probability setups.

14-Day Free Trial

M Trader Signal Indicator

Momentum trade entry signal indicator designed to capture explosive market moves with precision timing and adaptive filters.

14-Day Free Trial

Trade Copier

Mirror trades instantly across multiple NinjaTrader accounts with perfect synchronization of entries, stops, and targets — zero delays, zero mismatches.

14-Day Free Trial

Risk Reward ADV

Draw and manage risk-to-reward zones directly on your chart with free-hand precision, adjustable targets, and instant visual feedback for smarter trade planning.

14-Day Free Trial

Bar Based Risk Reward

Bar-based risk-to-reward tool that auto-plots targets and stops from candle size, giving instant visual ratios for every setup.

M Trader

Momentum-based auto-trader that executes powerful continuation setups with dynamic risk control, trailing targets, and daily account protection.

Reversal Strategy

Precision reversal-entry auto-trader that identifies exhaustion zones and manages risk automatically for confident counter-trend trading.

J Strategy

With a limit of 1 quality trade per market each day, strategy targets only the strongest signals to catch big market shifts.

VPS for Trading

High-performance VPS built for traders and auto-traders, offering ultra-low latency, 24/7 uptime, and full NinjaTrader support from us — from setup to strategy optimization.