Reversal Strategy for NinjaTrader 8 — Full Setup, Testing & Risk Guide

Table of Contents 🔗

- 1. Introduction

- 2. Installation

- 3. Strategy Setup (Control Center)

- 4. Testing & Performance Analysis

- 5. Key Settings & Parameters

- 5.1 Trading Hours (session window)

- 5.2 Risk/Reward & Entry Candle Size

- 5.3 Break-Even (optional)

- 5.4 Trailing Stop (optional)

- 5.5 Daily PnL Limits (Loss/Target; Account PnL limit)

- 5.6 Long/Short toggles & Contract Quantity

- 5.7 News Release Auto-Stop Windows (08:30, 10:00, 10:30, 14:00)

- 5.8 Trade Log (CSV in Documents)

- 6. Problem Solving

- 7. Good Practice & Risk Controls

- 8. FAQ

- 9. Resources

- 10. Strategy Parameters Table

1. Introduction 🔗

The Reversal Strategy is a rules-based automated trader for NinjaTrader 8 that looks for exhaustion and snap-back moves, then manages the entire position with predefined risk controls. It’s built for disciplined execution: entries, stops, and targets are placed instantly and adjusted by the engine, not emotions.

Out of the box, it supports both long and short reversals, configurable session windows, optional break-even and trailing logic, daily PnL limits, and scheduled “news pause” windows. You can test it safely on SIM, compare template sets, and only then migrate to live once you’re comfortable with performance.

2. Installation 🔗

Installing the Reversal Strategy in NinjaTrader 8 is quick and follows the same process as other MAS Capital add-ons. Make sure you’ve downloaded the provided .zip file before starting.

- Open the NinjaTrader 8 Control Center.

- Go to Tools > Import > NinjaScript Add-On…

- Select the Reversal Strategy

.zipfile and click Import. - Accept any overwrite/confirmation prompts. This will not affect unrelated indicators or strategies.

- Restart NinjaTrader to finalize installation.

3. Strategy Setup (Control Center) 🔗

After importing the Reversal Strategy, the next step is to configure it correctly in the NinjaTrader 8 Control Center. This ensures that testing, performance tracking, and live deployment all run smoothly. Think of this as “wiring up” the engine to the account you want it to trade on.

3.1 How many SIM accounts do I need? 🔗

If you plan to test multiple templates at once, you’ll need one SIM account per template. This avoids mixing results together, which makes it easier to review the individual performance of each configuration.

- Template Set #1 = SIM account #1 (e.g., SIM101 for Template A)

- Template Set #2 = SIM account #2 (e.g., SIM102 for Template B)

- Template Set #3= SIM account #3 (SIM103, and so on)

3.2 Create SIM accounts 🔗

NinjaTrader comes with a default simulation account (SIM101), but you can add as many as you need:

- In Control Center, click on the Accounts tab.

- Right-click anywhere inside the Accounts grid and choose Add Account.

- Select Simulation as the account type.

- Name the account (e.g., SIM102 or SIM103 for clarity).

- Repeat this process until you have enough accounts for your template testing.

3.3 Connect templates to SIM accounts 🔗

Once SIM accounts are ready, link each Reversal Strategy template to the correct account:

- Open the Strategies tab in Control Center or right-click on a chart and choose Strategies….

- Locate Reversal Strategy in the list of available strategies.

- Load your template file.

- From the Account dropdown, select the SIM account that corresponds to this template (e.g., SIM102).

- Set Enabled to True to activate the strategy.

4. Testing & Performance Analysis 🔗

Thorough testing is the bridge between theory and live deployment. The Reversal Strategy is designed to be rules-driven, but how it performs depends heavily on the templates, markets, and session times you select. By testing methodically, you avoid surprises when moving into live trading.

4.1 Running the strategy in SIM 🔗

Always begin on simulation accounts. This gives you real-time order flow and fills without financial risk.

- Load the Reversal Strategy through the Control Center.

- Select the appropriate SIM account (e.g., SIM101, SIM102).

- Enable the strategy and allow it to run during live market hours.

- Monitor how entries, stops, and targets are placed automatically.

4.2 Reviewing performance data 🔗

Use multiple tools to evaluate how the strategy behaves over time:

- NinjaTrader Performance Reports: Run reports per SIM account to check win rate, average trade, max drawdown, and daily PnL.

- CSV Trade Log: The strategy automatically writes trades into your Documents folder. This file can be opened in Excel or imported into Google Sheets for deeper analysis.

4.3 Building a reliable sample size 🔗

A single good or bad day isn’t enough to judge performance. You’ll want a meaningful sample of trades to understand the strategy’s edge:

- Run tests across at least 2–3 days of live sessions.

- Evaluate results per market: NQ, ES, CL, GC may behave very differently.

- Look for consistency in weekly results, not just big wins.

4.4 Transitioning into live trading 🔗

Once you’ve confirmed the template works well on SIM, scale carefully:

- Start with micro contracts on live (e.g., MNQ, MES) to minimize risk.

- Confirm live fills behave similarly to SIM results.

- Gradually increase position size only after several consistent days of positive live results.

5. Key Settings & Parameters 🔗

The Reversal Strategy includes a flexible set of parameters so you can adapt it to different markets, times of day, and risk preferences. Understanding these options is critical for aligning the system with your trading goals.

5.1 Trading Hours (session window) 🔗

You can define when the strategy is active. For example, limit trading to 09:30–11:30 EST for the U.S. session, or test evening windows for lower volatility setups.

5.2 Risk/Reward & Entry Candle Size 🔗

Templates use predefined stop-loss and target ratios. You can also filter trades based on maximum candle size for entries.

5.3 Break-Even (optional) 🔗

Enable break-even logic to move your stop to entry after a certain profit threshold. This locks in safety while allowing trades to develop further.

5.4 Trailing Stop (optional) 🔗

The trailing stop feature dynamically moves your stop as price advances. This helps capture extended moves while still protecting profits.

5.5 Daily PnL Limits (Loss/Target; Account PnL limit) 🔗

You can define maximum daily loss or profit targets. Once reached, the strategy disables itself for the session to prevent overtrading.

5.6 Long/Short toggles & Contract Quantity 🔗

Choose whether the strategy takes only long trades, only short trades, or both. Adjust contract size per market to align with your account risk.

5.7 News Release Auto-Stop Windows (08:30, 10:00, 10:30, 14:00) 🔗

The strategy includes predefined “pause windows” around major U.S. economic releases. No new trades will be taken during these times to avoid slippage.

5.8 Trade Log (CSV in Documents) 🔗

Every trade is recorded in a CSV file inside your Documents folder.

6. Problem Solving 🔗

Even with a clean setup, you may encounter issues when enabling or running the Reversal Strategy. Below are the most common problems and how to resolve them quickly.

6.1 Machine ID & license problems 🔗

Your license is tied to your NinjaTrader Machine ID. If you reinstall Windows, switch computers, or reset NinjaTrader, your Machine ID will change and the license may stop working.

- Check your Machine ID under Help > About in NinjaTrader.

- Contact [email protected] with your new ID for reactivation.

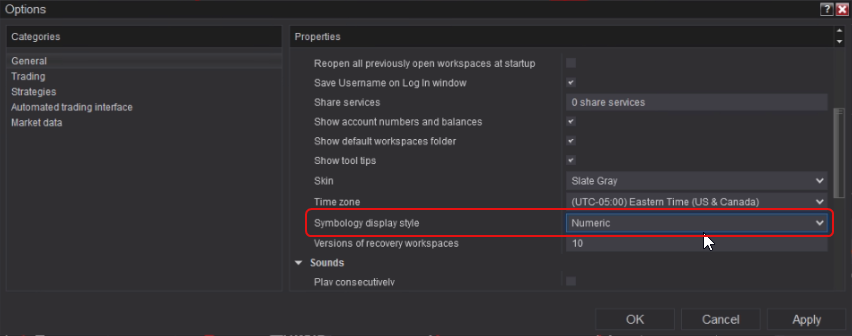

6.2 Strategy ON but no trades? (symbology) 🔗

If the strategy is enabled but does not take trades, the most common cause is incorrect market symbol mapping.

- Confirm you are using the correct symbol (e.g., NQ 12-25 instead of an expired contract).

- Check that your broker’s data feed matches NinjaTrader’s symbol format.

6.3 Strategy ON but still no trades? (contract rollover) 🔗

If you are on an expired contract, no trades will trigger.

- Go to Tools > Database Management and roll to the current contract.

- Update any charts or strategies to use the new contract month.

6.4 Can’t enable any strategy? 🔗

If you cannot enable the strategy at all:

- Confirm your NinjaTrader license is valid and allows automated trading.

- Restart NinjaTrader and check the log tab for errors.

- Ensure there are no conflicting add-ons installed.

6.5 Remote support request 🔗

If issues persist, remote support can be arranged via AnyDesk or a similar tool. Contact [email protected] to schedule a session.

7. Good Practice & Risk Controls 🔗

The Reversal Strategy is designed to execute consistently, but your results depend on how you manage risk and apply trading discipline. These practices help ensure smoother performance and protect your account from unnecessary drawdowns.

7.1 Always start with SIM 🔗

Simulation is your safety net. Test every new template, parameter tweak, or market setup in a SIM account before moving to live. This gives you a clear view of how the system behaves in real-time without risking capital. We suggest to always have sim account running alongside with your main account to compare the results.

7.2 Scale gradually 🔗

Jumping from SIM to full-size contracts is risky. A better path is:

- Run SIM for 2-3 days.

- Go live with micro contracts (e.g., MNQ, MES). Or use only best performing templates from the set with 1 MINI contract.

- Increase gradually to mini contracts once live results confirm stability.

- Only scale further if daily drawdowns remain within your comfort zone/account limits.

7.3 Keep templates separated 🔗

Running multiple templates from the same market on the same account muddies performance data. Assign each template set its own SIM or live account for clarity. This way, you can instantly see which ones are performing well and which should be paused or adjusted.

7.4 Respect daily limits 🔗

Overtrading can destroy even a solid strategy. Daily PnL limits stop you from “chasing losses” or “giving back” strong gains.

- Daily loss limit: Pause trading once hit. Protects account from spiraling drawdowns.

- Daily profit target: Lock in a strong day by stopping when the goal is reached.

- Account-wide PnL cap: Particularly useful for prop firm accounts to prevent breaches.

7.5 Keep logs & review weekly 🔗

Every trade is recorded in a CSV file. Combine this with NinjaTrader’s performance reports to analyze:

- Win/loss streaks

- Best and worst times of day

- Which markets give most consistent results

- Average trade size vs. max drawdown

7.6 Stay updated on contracts 🔗

Index Futures roll quarterly. If you forget to update symbols, the strategy will stop trading because it’s running on expired contracts. Always check contract months in Control Center and roll forward when prompted.

7.7 Respect the psychology factor 🔗

Automation doesn’t remove psychology completely. The temptation to override the strategy or disable it mid-trade can harm results. Trust your templates, and let the system execute.

8. FAQ 🔗

Does the Reversal Strategy work on all markets?

Yes. It can run on futures like NQ, ES, CL, and GC, as well as Forex and CFDs, but each market requires parameter adjustments for volatility and session times.

Can I run multiple templates at once?

Yes. Each template set should be connected to a separate SIM or live account for clear reporting and performance tracking.

What happens if I restart NinjaTrader?

The strategy will re-load, but trades are not re-attached automatically. Always confirm that strategies are enabled after restarting.

Does it include break-even and trailing stop logic?

Yes. Both can be enabled or disabled in the parameters depending on your risk management style.

Can I use it with a prop firm account?

Yes. Daily PnL limits and account-wide risk controls make it compatible with prop firm evaluation rules.

Where can I find trade logs?

All trades are saved to a CSV file in your Documents folder, which you can open in Excel or Google Sheets.

How do I get support if something doesn’t work?

You can reach out to [email protected]. If needed, remote support via AnyDesk can be arranged.

What account size do I need?

That depends on your contract size and daily loss limit. Starting with micro contracts (MNQ, MES) allows testing with smaller accounts. Full contracts require higher margin.

How do I update to a new version?

Uninstall the old version from NinjaTrader, then import the new .zip file. Always restart NinjaTrader after updating. Templates can be re-applied without reconfiguration.

Will it conflict with other MAS Capital strategies?

No. You can run Reversal Strategy alongside M Trader, J Strategy, or other add-ons, as long as each has its own instance.

Does the strategy trade overnight?

By default, trading hours are limited to your configured session window. If you want overnight activity, expand the session times, but always test this first in SIM.

Can I manually close trades?

Yes, but it’s not recommended. Manual overrides may interfere with the strategy’s trade management logic. If you close trades early, the system won’t re-enter until the next signal.

9. Resources 🔗

Here are useful links and references to help you get the most out of the Reversal Strategy:

- MAS Capital Automated Strategies — Explore other automated systems like M Trader and J Strategy.

- Free Indicators Pack — Boost your NinjaTrader workspace with essential tools.

- J Strategy Setup Guide — Compare another MAS Capital strategy in full detail.

- Official NinjaTrader 8 Help Guide — Reference for platform-specific questions.

- [email protected] — Direct support contact for licensing or troubleshooting.

10. Strategy Parameters Table 🔗

This table covers all configurable parameters of the Reversal Strategy, grouped by category. Use it as a quick reference when setting up or optimizing templates.

| Parameter | Group | Default | Explanation | Example Use |

|---|---|---|---|---|

| ⏰ Trading Hours | ||||

| OpeningRangeStart | Trading Hours | 03:00 | Time the strategy starts accepting trades. | Set to 09:30 for U.S. cash market open. |

| OpeningRangeEnd | Trading Hours | 10:00 | Time the strategy stops accepting new trades. | Extend to 16:00 for full NY session coverage. |

| 📉 Strategy Limits | ||||

| LossLimit | Strategy Limit | 1000 | Daily maximum loss allowed before trading halts. | Reduce to $300 for prop firm accounts. |

| TargetLimit | Strategy Limit | 1000 | Daily profit target. Strategy halts once reached. | Lock in profits at $500/day. |

| AccPnLLimit | Strategy Limit | false | When true, uses total account PnL to enforce stop. | Enable for prop firm risk rules. |

| 📑 Template | ||||

| TemplateName | Template | — | Custom name for your template set. | “NQ Reversal 5 Min”. |

| ⚙️ Parameters | ||||

| BarsLookBack | Parameters | 5 | How many bars back to check for pivot/reversal. | Decrease to 3 for wider pattern detection. |

| SignalValidBars | Parameters | 2 | How many bars after signal trigger it remains valid. | Use 1 for stricter entries. |

| KeepAlive | Parameters | 2 | Bars to keep pending order alive after confirmation. | Set to 5 for slower-moving markets. |

| WaitBars | General Configuration | 1 | Bars between trades to prevent back-to-back entries. | Increase to 3 to reduce clustering. |

| EntryCandleSizeLimit | Parameters | 999 | Maximum candle size for entry signal. | Lower to 100 ticks for NQ to avoid big spikes. |

| MovingAverageDirection | Parameters | false | Require MA slope alignment for trade entry. | Enable to filter only trades in trend direction. |

| MovingAverageSide | Parameters | false | Require price to be on correct side of MA. | Only long if price is on general trend side. |

| MarketSide | Parameters | false | Optional hard-coded bullish/bearish bias. | Use true to force one-direction trading. |

| TradeLog | Parameters | true | Enable/disable CSV trade log. | Keep on for performance tracking. |

| LongTrades | Parameters | true | Allow long entries. | Disable if testing shorts only. |

| ShortTrades | Parameters | true | Allow short entries. | Disable if bullish-only strategy. |

| 📈 ATM Parameters | ||||

| ContractQuantity | ATM Parameters | 1 | Number of contracts per trade. | Start with 1 micro contract. |

| RRratio | General Config | 1.0 | Risk/reward ratio (stop vs target). | Set to 2.0 for 1:2 RR. |

| ⚡ ATM Setup | ||||

| UseBEfeature | ATM Setup | false | Enable/disable break-even stop feature. | Turn on for funded accounts. |

| BETriggerAfterLevel | ATM Setup | 25 | Profit threshold (%) to activate BE. | Set to 20 for tighter safety. |

| BETicks | ATM Setup | 0 | Number of ticks stop is moved past entry on BE. | +2 ticks to cover fees. |

| UseTrailfeature | ATM Setup | false | Enable/disable trailing stop feature. | Enable for trending markets. |

| TrailingStep | ATM Setup | 10 | Steps (%) before stop trails forward. | Tighten to 5 for scalping. |

| TrailingProtection | ATM Setup | 5 | Trailing buffer distance behind price. | Keep at 5 for balanced exits. |

| 📰 Exit & Stop During News Releases | ||||

| Stop0830 | News | false | Pause trades around 8:30 AM news (CPI, NFP, PPI). | Enable when trading U.S. indices. |

| Stop1000 | News | false | Pause trades at 10:00 AM (ISM, Consumer Confidence). | Enable for NQ/ES. |

| Stop1030 | News | false | Pause trades at 10:30 AM (Crude Oil Inventory). | Enable when trading CL futures. |

| Stop1400 | News | false | Pause trades at 2:00 PM (FOMC announcements). | Enable for risk-sensitive sessions. |

Explore Our Add-Ons & Tools

Enhance your NinjaTrader® 8 workflow with MASCapital’s collection of powerful add-ons and free tools. From performance utilities to precision indicators, every tool is built to simplify your trading experience and improve execution speed.

Lifetime Free

Free Indicators Pack

Download a complete starter set of NinjaTrader indicators to boost your technical edge with structure, momentum, and trend clarity — free forever.

Lifetime Free

Auto-Login & Cleaner

Save time and boost stability by automatically logging into NinjaTrader and clearing old files, logs, and cache with a single click.

14-Day Free Trial

Advanced Trader

Visualize active positions, stops, and targets directly on your chart while managing orders. Control every aspect of your trade!

7-Day Free Trial

Trade Analyzer + Web Report

Instantly analyze and visualize your NinjaTrader performance with detailed stats, charts, and reports that reveal your real trading edge.

14-Day Free Trial

Reversal Signal Indicator

Identify major turning points early using precision reversal logic that filters noise and highlights high-probability setups.

14-Day Free Trial

M Trader Signal Indicator

Momentum trade entry signal indicator designed to capture explosive market moves with precision timing and adaptive filters.

14-Day Free Trial

Trade Copier

Mirror trades instantly across multiple NinjaTrader accounts with perfect synchronization of entries, stops, and targets — zero delays, zero mismatches.

14-Day Free Trial

Risk Reward ADV

Draw and manage risk-to-reward zones directly on your chart with free-hand precision, adjustable targets, and instant visual feedback for smarter trade planning.

14-Day Free Trial

Bar Based Risk Reward

Bar-based risk-to-reward tool that auto-plots targets and stops from candle size, giving instant visual ratios for every setup.

M Trader

Momentum-based auto-trader that executes powerful continuation setups with dynamic risk control, trailing targets, and daily account protection.

Reversal Strategy

Precision reversal-entry auto-trader that identifies exhaustion zones and manages risk automatically for confident counter-trend trading.

J Strategy

With a limit of 1 quality trade per market each day, strategy targets only the strongest signals to catch big market shifts.

VPS for Trading

High-performance VPS built for traders and auto-traders, offering ultra-low latency, 24/7 uptime, and full NinjaTrader support from us — from setup to strategy optimization.